what is form e malaysia

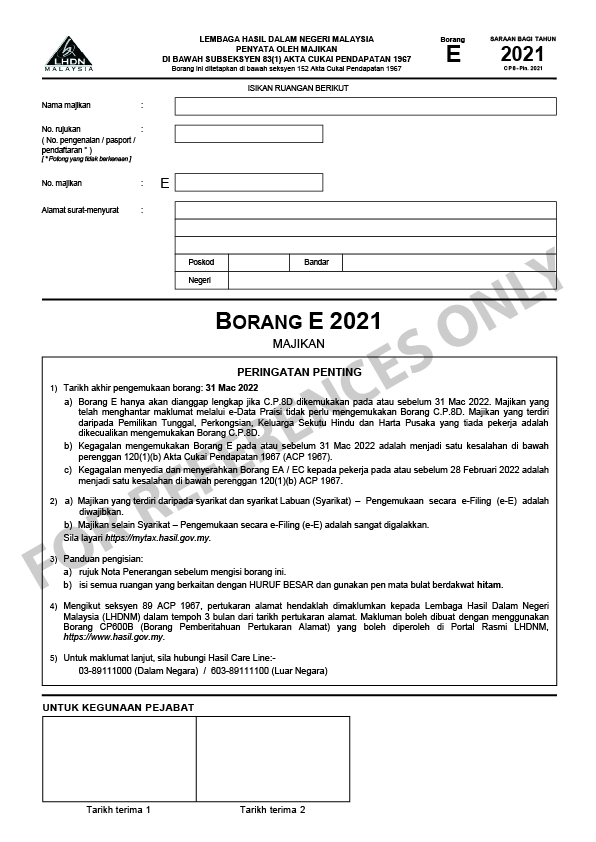

Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Malaysia Tax Guide What Is And How To Submit Borang E Form E

INDONESIA LAOS MALAYSIA MYANMAR PHILIPPINES SINGAPORE THAILAND VIETNAM 2.

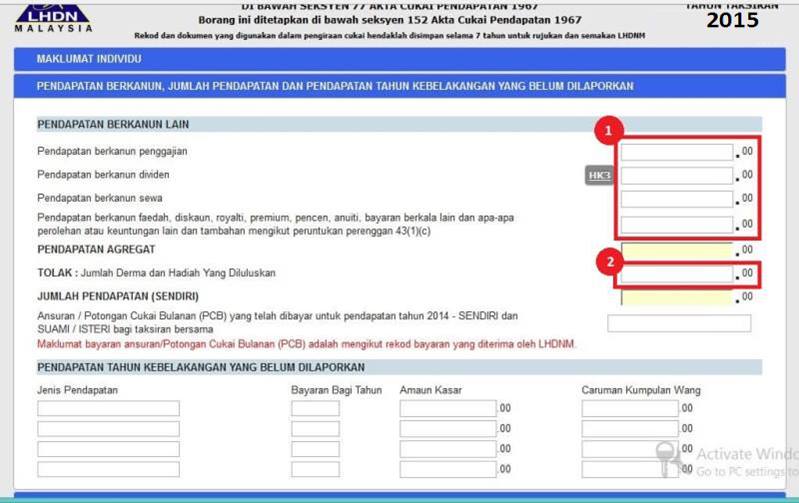

. Form E is a declaration report that must be filed by every employer to the IRB every year by the 31st of March in order to notify the IRB of the number of. In simple terms Form E is a declaration report to inform the IRB on the number of employees and the list of employees income details. How To Create A Free Payslip Template In Excel Pdf Word Format How To Wiki Payroll Template Receipt Template Templates.

Form EA form is issued by the Inland Revenue Board of Malaysia to be completed by employer in reporting the. Pin On Bangladesh Malaysia Entri Visa Sample Invitation Letter For Event Sample Of Invitation Letter Theory Test Scada Systems Risk Management Training Workshop. Malaysia Visa From Pak.

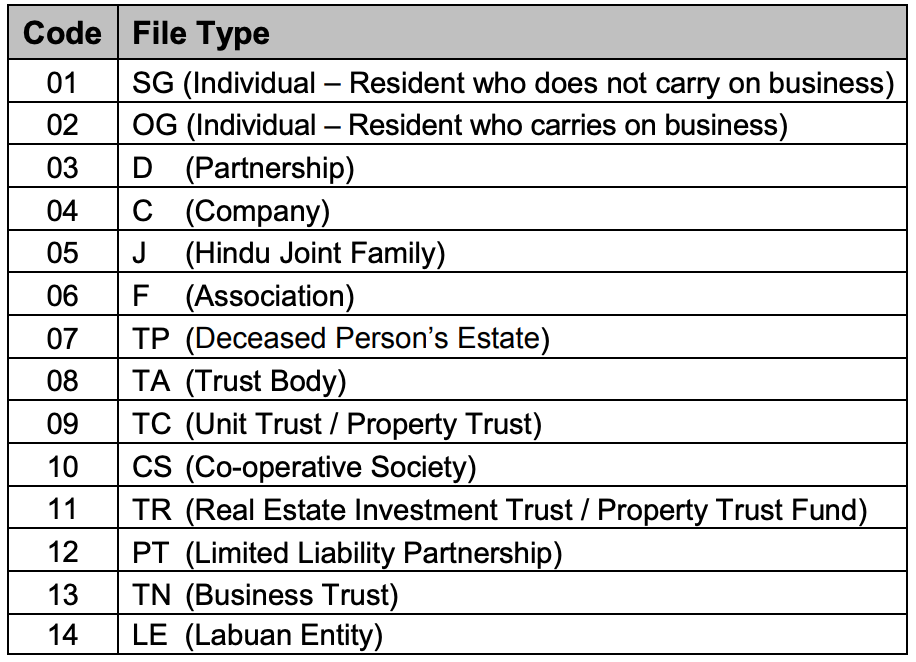

What is form E Malaysia. In Malaysia the equivalent of 9th grade is Form 3 Tingkatan 3. Form E is a form used by company to.

What is Form EA. Online Appointment for Malaysia. Form E The deadline for submitting Form E is 31032022.

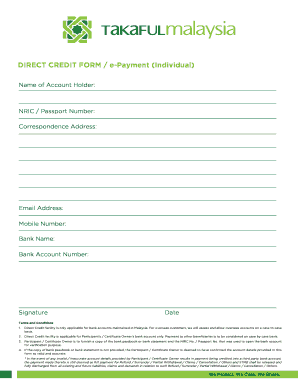

Part F of Form EA is where. The deadline for filing tax returns in Malaysia has always been. W-8BEN-E Form For entities use W-9 Form For US person AIA Vitality Direct Debit Authorization Form.

An EA form is a report of employees salaries and statutory contributions paid for the past year. Every employer must provide his employee with their EA Form by the last day of February. What is Form E.

Income Tax is a type of tax which government impose on income earned by personal or business such as monthly salary and business income. Form e-E All companies must file Borang E. 1300-88-1899 For Overseas Customers 603 2056 1111.

31 March 20 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2020. Employers who have e-Data Praisi need not. Effective from Year of Assessment 2014 all dormant.

1 Due date to furnish this form. Form E 161210_Form E colour 121610 1220 PM Page 1. What are TP 1 TP 2 TP 3 forms in Malaysia.

Employers can start preparing for Form E now. April 30 for manual submission May 15 for electronic filing ie. All Malaysian business irregardless of large medium or small companies are held to submit a Form E to the.

Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later. Lhdn Form E 2019 Is Released Su Fang Associates Facebook. Choose any of the following options.

According to the law.

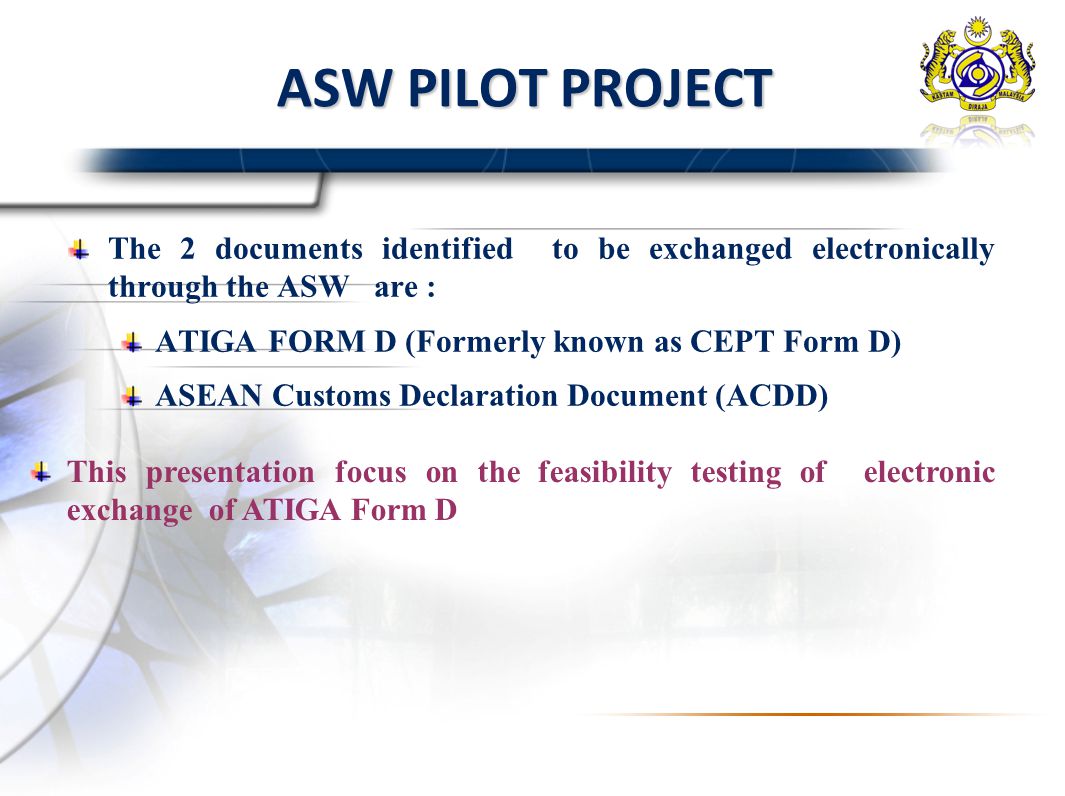

Ministry Of International Trade And Industry Malaysia Endorsement Of Certificate Of Origin For Atiga E Form D Is Currently Paperless And Will Not Be Processed Manually At Menara Miti And Its State

Have You Filed Your Form E Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

338 630 Tons S2205 Stainless Steel Plates To Malaysia Bebon Steels

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Brepairb Form Fill Out Sign Online Dochub

Form E Company Form E Service At Cost Price Ytd Logistic

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

How To Step By Step Income Tax E Filing Guide Imoney

Preferential Certificate Of Origin

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Are My Responsibilities As A Taxpayer Tax Lawyerment Knowledge Base

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Preferential Certificate Of Origin

Business Income Tax Malaysia Deadlines For 2021

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Electronic Exchange Of Atiga Form D The Malaysian Experience Ppt Video Online Download

Comments

Post a Comment